She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. A solvency ratio is a key metric used to measure an enterprise’s ability to meet its debt and other obligations. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- This amount will be shown under the shareholder’s equity section under the liabilities section of the balance sheet.

- This is also calculated in a similar way to the receivables collection period.

- The degree of gearing, whether low or high, reveals the level of financial risk that a company faces.

- A company with a highly geared capital structure will have to pay high fixed interest costs on long-term loans and more dividends on preferred stock.

Interest coverage ratio is the financial ratio that looks at the amount of time the company can the interest to its lenders by comparing the earnings before interest and tax to the interest expenses. Likewise, it shows the company’s ability to pay interest to its lenders. Interest Coverage RatioThe interest coverage ratio indicates how many times a company’s current earnings before interest and taxes can be used to pay interest on its outstanding debt. It can be used to determine a company’s liquidity position by evaluating how easily it can pay interest on its outstanding debt. Financial LeverageFinancial Leverage Ratio measures the impact of debt on the Company’s overall profitability.

What is Financial Gearing?

Companies requiring high investment in tangible assets are commonly highly geared. Consequently, it is difficult to generalise about when capital gearing is too high. However, most accountants would agree that gearing is too high when the proportion of debt exceeds the proportion of equity. Gearing relates to an organisation’s relative levels of debt and equity and can help to measure its ability to meet its long-term debts.

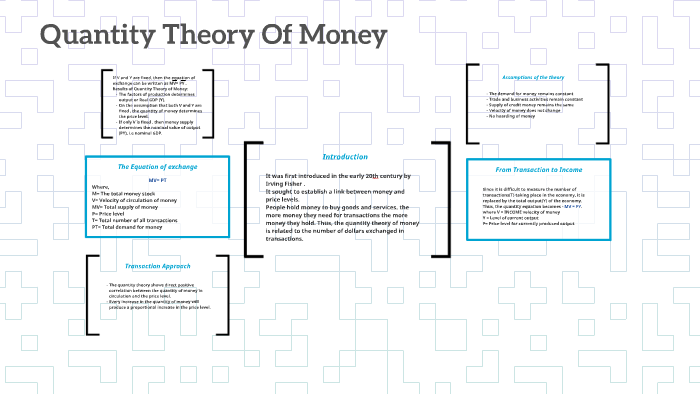

In general, the company is usually considered risky if it has a large proportion of the borrowings. This is due to the interest and principal repayment is a legal obligation that the company must meet to avoid insolvency. As a result, a higher capital gearing usually means a higher risk for the company. Degree Of Financial Leverage FormulaThe degree of financial leverage formula computes the change in net income caused by a change in the company’s earnings before interest and taxes. It aids in determining how sensitive the company’s profit is to changes in capital structure.

For example, companies in the agricultural industry are affected by seasonal demands for their products. They, therefore, often need to borrow funds on at least a short-term basis. For understanding the meaning of the capital gearing ratio, we need to first understand the meaning of capital gearing.

Why does it matter to know whether the firm’s capital is high geared or low geared? Companies that are low geared tend to pay less interest or dividends, ensuring the interest of common stockholders. On the other hand, highly geared companies need to give more interest, increasing investors’ risk. For this reason, banks and financial institutions don’t want to lend money to companies that are already highly geared.

Capital gearing ratio

It helps the investors determine the organization’s leverage position and risk level. Debt To Equity RatioThe debt to equity ratio is a representation of the company’s capital structure that determines the proportion of external liabilities to the shareholders’ equity. If a company is said to be highly geared, it means that it has more debt than its own funds in its capital structure.

And, we generally consider financial leverage good for a company provided that the company has enough earning capacity to discharge its fixed payment obligations regularly. Here, the company has more funds that bear a fixed cost in comparison to the owners’ funds. Below is a screenshot from CFI’s leveraged buyout modeling course, in which a private equity firm uses significant leverage to enhance the internal rate of return for equity investors. A highly geared firm is already paying high amounts of interest to its lenders and new investors may be reluctant to invest their money, since the business may not be able to pay back the money. Even a slight decrease in the Return On Capital Employed ratio of a highly geared company can cause a large reduction in its Return On Equity .

We need to calculate the capital gearing ratio and see whether the firm is high geared or low geared for the last two years. First of all, capital gearing ratio is also called financial leverage. Preferred StockA preferred share is a share that enjoys priority in receiving dividends compared to common stock. The dividend rate can be fixed or floating depending upon the terms of the issue. However, their claims are discharged before the shares of common stockholders at the time of liquidation. The gearing ratio is often used interchangeably with the debt-to-equity (D/E) ratio, which measures the proportion of a company’s debt to its total equity.

Assume that a company can issue three types of securities, i.e., equity shares, preference shares and debentures. Capital Gearing determines the ratio between the various types of securities to the total capitalisation. When a company possesses a high gearing ratio, it indicates that a company’s leverage is high.

How do companies reduce Capital Gearing Ratio?

The higher the capital gearing of a company, the more speculative will be its equity shares. The equity shareholders may either get higher dividend or no dividend. If a large amount of profit is left after paying interest to debenture holders and dividend to preference shareholders, it can be distributed among the equity shareholders. For example, a startup company with a high gearing ratio faces a higher risk of failing. However, monopolistic companies like utility and energy firms can often operate safely with high debt levels, due to their strong industry position.

A highly geared company usually has a lower dividend payout ratio for this very reason. Thus investors looking to increase their earnings will prefer a low geared company. Debt To EquityThe debt to equity ratio is a representation of the company’s capital structure that determines the proportion of external liabilities to the shareholders’ equity.

Our experts suggest the best funds and you can get high returns by investing directly or through SIP. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. On the other hand, even a slight improvement in such a company’s ROCE can lead to a large increase in its ROE. Hence, the capital provided by these two is said to offer a fixed return.

Ratio Analysis

It should, however, be noted that business control is centered in the hands of equity shareholders who have the voting right in the general body meeting to control the management of the company. Preference shareholders, if at all, possess very limited right of voting and debenture-holders have no right of voting. At times, companies may increase gearing in order to finance a leveraged buyout or acquire another company. For example, if a company is said to have a capital gearing of 3.0, it means that the company has debt thrice as much as its equity.

CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns capital gearing ratio & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

The gearing level is another way of expressing the capital gearing ratio. For every $4 contributed by common stockholders, there are only $3 contributed by fixed cost bearing funds. Return on equity is a measure of financial performance calculated by dividing net income by shareholders’ equity. A high gearing ratio typically indicates a high degree of leverage, although this does not always indicate a company is in poor financial condition. Instead, a company with a high gearing ratio has a riskier financing structure than a company with a lower gearing ratio.

By contrast, both preference shareholders and long-term lenders are paid a fixed rate of return regardless of the level of the company’s profits. PerpetuityPerpetuity is the most commonly used in accounting and finance, which means that a business or an individual receives constant cash flows for an indefinite period . According to the formula, its present value is calculated by dividing the amount of the continuous cash payment by the yield or interest rate.

The following information has been taken from the balance sheet of L&M Limited. We note that two items have contributed to a decrease in Shareholder’s equity. Let us investigate what has caused this sudden decrease in Shareholder’s equity. For example, in 2015, Pepsi’s debt was $32.28 billion compared to $28.90 billion.

We will first calculate the total interest and EBIT of the company and then use the above equation. Liquidity measures the ability of the organisation to meet its short-term financial obligations. Save taxes with ClearTax by investing in tax saving mutual funds online.

In simple terms, it is the net impact of the organization’s cash inflow and cash outflow for a particular period, say monthly, quarterly, annually, as may be required. Treasury StockTreasury Stock is a stock repurchased by the issuance Company from its current shareholders that remains non-retired. Moreover, it is not considered while calculating the Company’s Earnings Per Share or dividends.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Full BioMichael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. Although interest coverage is not involving with paying back the principal to lenders, it is still very important to the company to properly manage it.

Moreover, high & low ratio implies high & low fixed business investment cost, respectively. Capital Gearing Ratio is a kind of solvency ratio that determines the ratio of fixed return capital to ordinary return capital/share capital. The proper balance between debt and equity can be maintained with the help of financial gearing management. Financial InstitutionFinancial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients. Some of these are banks, NBFCs, investment companies, brokerage firms, insurance companies and trust corporations.