This is because, despite sellers attempting to push the market lower, buyers remain active and prevent a significant decline. However, it is worth noting that the inability of buyers to push the market above may indicate a potential weakening of bullish momentum. Traders may enter the trade above the open/close of the doji’s candle or if the proceeding bar closes above the doji’s open or close. Dragonfly Doji patterns are somewhat rare in the market but they signal increasing potential that price trends are about to see a significant turnaround. Following a longer-term downtrend, the majority of the market’s momentum is strongly focused on the downside. Once this price momentum reaches a point of exhaustion, its final point of completion is usually expressed as a “flash” event to the downside.

Learn About the Doji Candlestick Pattern – ThinkMarkets

Learn About the Doji Candlestick Pattern.

Posted: Fri, 04 Sep 2020 23:45:17 GMT [source]

With no more sellers left in the market, buyers are able to enter at the beginning of the next uptrend. Ultimately, a strong price performance on the day that follows the Dragonfly pattern helps to confirm the reversal. A long lower shadow suggests aggressive selling during the candle period, but buyers could absorb the sale and push the price back up since the price closed near the open.

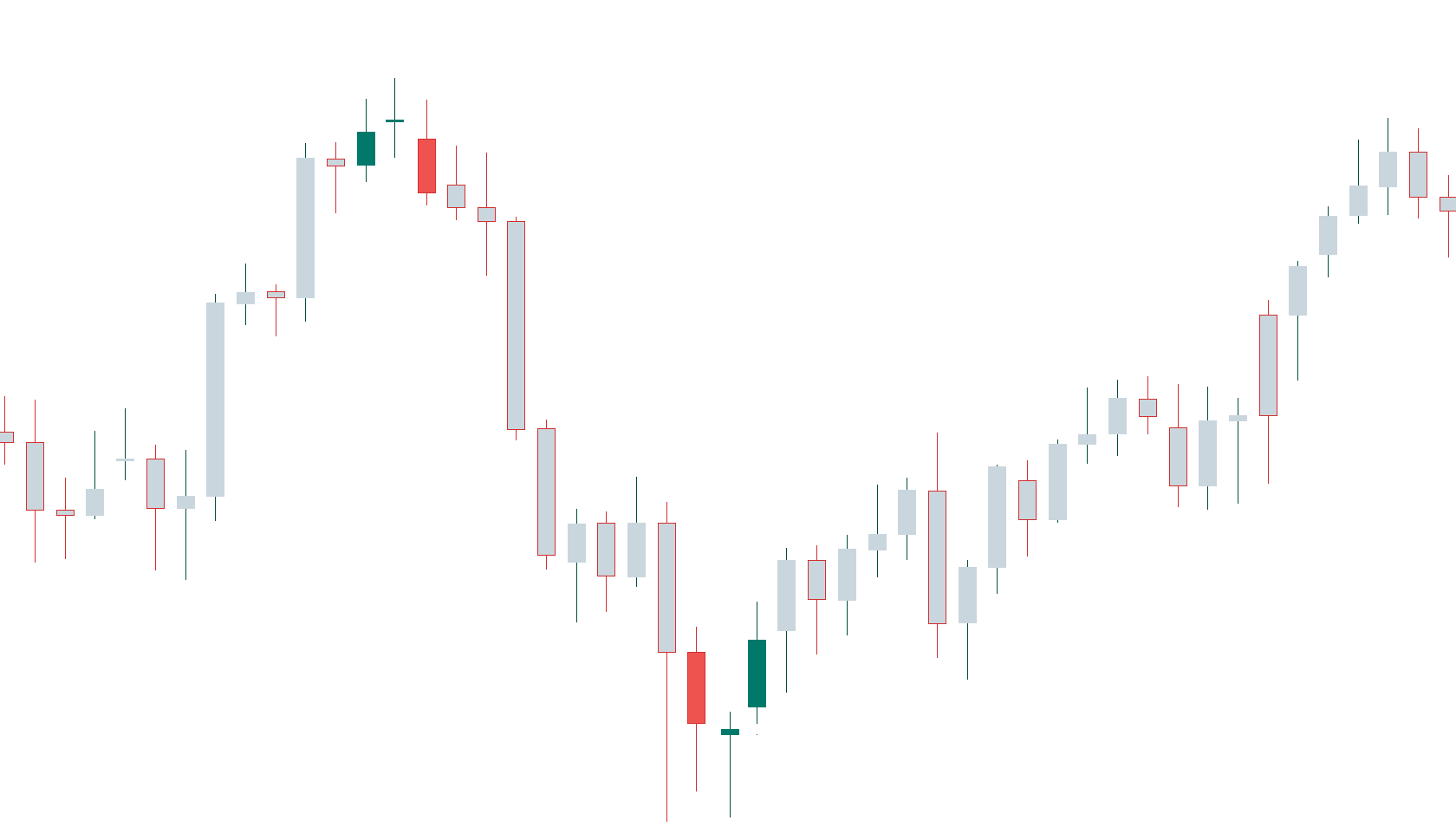

Bar Reversal Pattern

Different from the positive and negative candlesticks, a doji candlestick does not have a rectangular body. It is a rare type with equal open and close prices, which gives it a cross shape. Without other information, a doji candlestick is a neutral indicator, as it alone does not provide sufficient information to make trading decisions. There are three types of doji candlesticks – the gravestone doji, the long-legged doji, and the dragonfly doji. A dragonfly doji candlestick may be a reversal pattern when the price moves from above the opening price of a downtrend to below the opening price of an uptrend. The closing price of the downtrend session should be close to the opening price of the uptrend session, thereby forming a ‘T’-shape in the middle of the candlestick chart.

- When entering into long positions on a bullish Dragonfly Doji reversal, stop-loss orders are placed under the price low of the pattern.

- Once traders have confidence in their analysis, they can open an FXOpen account to actively participate in live market trading.

- If you are day trading, the Daily Pivot Points are the most popular, although the Weekly and Monthly are frequently used too.

- To make matters worse, it looks similar to other candlestick formations, such as Hammers or hanging man candles.

- The signal is confirmed if the candle following the dragonfly rises, closing above the close of the dragonfly.

It is worth noting that, like other candlestick patterns, the dragonfly doji does not always imply that a reversal is about to happen. As such, traders and investors must always wait for confirmation before placing a trade. Alone, doji are neutral patterns that are also featured in a number of important patterns.

Is this pattern bullish or bearish?

In both cases, the candle following the dragonfly doji needs to confirm the direction. If the candlestick occurs right after the bullish dragonfly rises and closes at a higher price, the price reversal has been confirmed, and trading decisions can be made. A dragonfly doji candlestick Doji, on the other hand, would indicate a price drop, also known as a bearish dragonfly, if the market had previously shown signs of strength. Doji’s with strong Bullish or Bearish implications, like the dragonfly doji, often make for good reversal candles.

Additionally, traders should consider the overall market conditions and look for any conflicting signals. It’s important to remain patient and wait for a clear confirmation before making any trading decisions based on the dragonfly doji pattern. In summary, while both the Hammer and Dragonfly Doji patterns signal potential bullish reversals after a downtrend, they differ in their formation. The Hammer has a small body at the top, while the Dragonfly Doji has little to no body. Both patterns indicate an increase in buying pressure and require confirmation from subsequent bullish candlesticks to validate the trend reversal. While the dragonfly doji has a long lower shadow and little or non-existent upper one, the gravestone or inverted dragonfly doji has a long upper wick and little or non-existent lower one.

There is no assurance the price will continue in the expected direction following the confirmation candle. The signal is confirmed if the candle following the dragonfly rises, closing above the close of the dragonfly. The stronger the rally on the day following the bullish dragonfly, the more reliable the reversal is.

Businesses With Low Startup Costs: Why Choose Day Trading?

This guide will discuss what Dragonfly Dojis are, their formation, and how traders can take advantage of them. Like all others, this pattern does not guarantee that the price will behave in any specific way; however, identifying Dragonfly Dojis is helpful for any trader. A step by step guide to help beginner and profitable traders have a full overview of all the important skills (and what to learn next 😉) to reach profitable trading ASAP.

One of three types of doji candlesticks, the other being gravestone doji and long-legged doji. Each candlestick pattern has unique features and characteristics, making them an effective way to track market trends when used appropriately. By understanding the https://g-markets.net/ pattern and trading it successfully, you have unlocked the potential of a good way that delivers price reversal signals. Use this to your advantage as a trader, and you will be able to make profitable trades in no time.

What Is the Difference Between a Doji and a Spinning Top?

As shown below, the dragonfly doji has a similar appearance to the hammer pattern or capital letter T. A Dragonfly Doji candlestick pattern is one of the four different types of Doji candlesticks. On a daily bar, why does the price only reverse enough to reach the daily opening level? Likely, it is because investors are neutral, no longer believing in the downtrend that prevailed in the early trading hours but also not sure the security has any real upward potential. Depending on the strength of the trend, different levels are more likely to work better with the Dragonfly Doji pattern.

- This indicates that buyers are now in control and that prices are likely to move higher from here.

- The candle following a potentially bearish dragonfly needs to confirm the reversal.

- There are several things to do to confirm a trend and prevent false signals.

- This is why traders require a confirmation candle to appear after the Dragonfly candle to confirm its signal.

Here you can learn more about the different Fibonacci retracement levels. The Dragonfly Doji pattern is also a mirrored version of the Gravestone Doji candlestick pattern. Everything that you need to know about the Dragonfly Doji candlestick pattern is here.

We want the everyday person to get the kind of training in the stock market we would have wanted when we started out. An investor could potentially lose all or more of their initial investment. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. Reversals usually happen when a stock hits support or resistance and does not break.

Among candlestick patterns, dragonfly doji candlesticks stand out because they have a long lower shadow and long upper shadow and can be found in all candlestick formations. This candlestick pattern can be more effective in certain scenarios, such as when it appears after a downtrend or during a period of consolidation. In these situations, the dragonfly doji can suggest a reversal in the trend or a potential break out. However, no single pattern or indicator can predict market movements with complete accuracy. Therefore, it is important to use the dragonfly doji pattern in conjunction with other technical analysis tools and to practice proper risk management techniques. Traders often pay close attention to them when making trading decisions.

Both indicate possible trend reversals but must be confirmed by the candle that follows. Candlestick patterns, as a psychological indicator, are used to communicate market psychology. Dragonflies have the best ability to signal when they are on a long-term downward trend. The reason for this is that this is a bullish reversal pattern that must reverse following a previous trend reversal. Bears appear to have capitulated as a result of the long downside wick. Using the dragonfly doji pattern in conjunction with automated trading software or algorithms is possible.

Correspondingly, the horizontal line of the Dragonfly pattern is at the top, while the horizontal line of the Gravestone pattern is fixed to the bottom. If all three conditions are met then there maybe opportunities for short trades on Dragonfies appearing during downturns. This was fueled by the news that Ark Invest and 21Shares filed applications with the US Securities and Exchange Commission (SEC) for a spot ETF on Ethereum.

Recall from our post on regular Doji candlesticks, the Open and Close price in a doji are the same. While this is true for all Doji’s, in some cases a stronger side is prevalent. Pivot Points are automatic support and resistance levels calculated using math formulas. Another popular way of trading the Dragonfly Doji candlestick pattern is using the Fibonacci retracement tool.