Contents:

However, you need to consider that exchange data costs extra. NYSE and Nasdaq data is cheap, but the fees can be high for CME and commodities exchanges. If you have an existing data-feed subscription with a compatible brokerage or data provider, you can use the existing data feed by connecting it with NinjaTrader.

https://trading-market.org/ following is a trading system based on using trend analysis and following the recommendation produced to determine which investments to make. Often, the analysis is conducted via computer analysis and modeling of relevant data and is tied to market momentum. We apply the technique to study price and volume movement as a means of us anticipating spikes or dips of traded securities. This kind of trading analysis is relevant for finance professionals whose job involves trading stocks, commodities, or currencies. Let’s look at an example of performance management through trend analysis. Suppose that a person in your organization needs to deliver the same report at a specific time every day.

What is the best free stock analysis software?

It’s generally a level where the stock has consolidated and held a number of times. A stock trend line is a sloping line that connects the candles of a candlestick pattern on a stock’s trend chart. Traders use this line to gauge whether a stock is keeping with the trend or breaking it. First login, then surveys, then reports, then advanced and then trend analysis. Trend trading is a style of trading that attempts to capture gains when the price of an asset is moving in a sustained direction called a trend. Trend analysis can have some potential disadvantages as a tool for making investment decisions.

- StocksToTrade has all these things — and it was built by traders for traders.

- In the past year, the Vanguard Value ETF has generated a total return loss of 6.9%, while the Vanguard Growth ETF has generated a total return loss of 17.2%.

- Join this educational stream to learn all about option buying and writing.

These stock market trend analysis play a crucial role in the efficient functioning of mining machinery, and their remanufacturing helps to reduce costs and environmental impact. Additionally, remanufacturing also helps to extend the lifespan of mining equipment. The Mining Remanufacturing Components market trend analysis indicates a positive outlook with a projected CAGR of 4.7% from 2023 to 2030. Technical analysis assumes that the market price of a stock reflects all that has or can affect a company.

What’s the Best Strategy for Technical Analysis?

Technical analysts consider that all the factors affecting the company are priced into the security. Start small — especially while you’re new and still experimenting with trend analysis as part of your day trading. Traders often combine multiple technical indicators to analyze stocks.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The S&P 500 was remarkably resilient in March, especially given the uncertainty radiating from the banking sector and tightening credit markets. The benchmark index was gaining ground in the first days of March until the collapse of Silicon Valley Bank sent global markets into a minor panic. After two weeks of relative market chaos, coordinated efforts by regulators and the big banks to backstop the industry calmed markets. The analysis you’ll find in the Stock Market Today is based on over 130 years of market history and a detailed study of every top-performing stock since the 1880s.

A simple moving average line equals the sum of all the prices of a stock over a given time, divided by that time frame. Some standard moving average time frames are 20, 50, and 200 days. Forex forecasting software provides technical indicators and trading tools to FX traders. Trade Ideas is an all-in-one solution and offers one of the best stock scanners for day trading, charting capabilities for technical analysis, and in-build artificial intelligence features.

Viant Technology Inc (DSP) Stock: What Does the Chart Say Monday? – InvestorsObserver

Viant Technology Inc (DSP) Stock: What Does the Chart Say Monday?.

Posted: Mon, 17 Apr 2023 17:00:46 GMT [source]

The technical analysis of stocks and trends has been used for hundreds of years. In Europe, Joseph de la Vega adopted early technical analysis techniques to predict Dutch markets in the 17th century. In its modern form, however, technical analysis owes heavily to Charles Dow, William P. Hamilton, Robert Rhea, Edson Gould, and many others—including a ballroom dancer named Nicolas Darvas. These people represented a new perspective on the market as a tide that is best measured in highs and lows on a chart rather than by the particulars of the underlying company.

We’re out of the bear market woods but not in the clear for the bull: Gilman’s Jenny Harrington

Trends can be both upward and downward, relating to bullish and bearish markets, respectively. While there is no specified minimum amount of time required for a direction to be considered a trend, the longer the direction is maintained, the more notable the trend. Trends are identified by drawing lines, known as trendlines, that connect price action making higher highs and higher lows for an uptrend, or lower lows and lower highs for a downtrend.

Is it Time to Dump Grupo Televisa SAB ADR (TV) Stock After it Has Fallen 2.01% in a Week? – InvestorsObserver

Is it Time to Dump Grupo Televisa SAB ADR (TV) Stock After it Has Fallen 2.01% in a Week?.

Posted: Mon, 17 Apr 2023 17:42:31 GMT [source]

What’s important to note is that, even though a company can’t really influence the development of these factors, it still needs to study them. Well, simply because it allows them to make important decisions and have insight on what could be coming next. Floor & Decor remains just shy of a cup-with-handle’s 99.47 buy point, with a 0.4% loss Monday.

#3 Look for Volume

If you are in this business for a while looking for a high-end tool that suits your need, then you should have a look at my extensive eSignal review. It covers all the things from functionalities, costs, advantages, and disadvantages. Stock Rover 14-day free trial (you will receive a 25% discount offer from Stock Rover about one week later).

Most traders see a few bullish indicators for a stock and jump right in … But experienced traders like being as certain as possible. They look for the stars to align so they have the best odds of success. Did a company finally get that big government contract? There’s a good chance it will have a multi-day uptrend.

When a stock approaches its prior high it creates an interesting psychological impact. Many investors will judge the stock as too expensive to purchase. However, if the stock is able to rise up through a resistance level on heavy volume, it should be looked at as a sign of strength. The amount of demand for the stock may be so high that it overwhelms the psychological impact of the resistance level.

It is a technique that attempts to predict the stock price movements in the future on the basis of the recently observed trend of the data of the stocks. Stock analysis helps traders to gain an insight into the economy, stock market, or securities. It involves studying the past and present market data and creating a methodology to choose appropriate stocks for trading. Stock analysis also includes the identification of ways of entry into and exit from the investments. Trend analysis is a type of technical analysis that helps investors identify the current price trends of a security.

It’s how you can better determine if it makes sense to hold on for a longer period of time. By looking at the data, traders can make intelligent decisions on what’s likely to happen with the stock … They can even see how investors’ emotions and market psychology play a role in stock movements. You can use technical analysis to help build the case for trades. In short, this is how you look at a stock’s movements, the overall market, and learn to recognize patterns using historical data. Trendet is a Python package to detect trends on the market so to analyze its behaviour.

- One of them is Charting which is the name of the analysis of the different price charts which contain the information of the price history of the financial assets.

- Additionally, never rely on a single trend-analysis method to make your investing decisions.

- However, since then, the company’s financials have been on an uptrend for the last two years.

That’s why I’m always prepared to take a loss … no matter how good a setup looks. The key is to focus on important catalysts — the ones that really move the stock. This isn’t a great entry point if you’re looking to get in on a trend.

That leaves price action, which is influenced by supply and demand. That’s what technical analysts focus on with full attention. Many believe that a company’s fundamentals and broad market factors are already priced into the stock … And that price movement is the main component for making smart trading plans. But if you’re a short-term trader, you need to know what a stock is doing currently. Make sure your charting software includes access to indicators, candlesticks, and drawing tools.

We use this type of analysis as a quality control mechanism to anticipate and better manage employees delivering their projects on time and within budget. And, based on this historical analysis, stakeholders can make an estimation about the future of their business. Cisco Systems remains squarely below a flat base’s 51.84 buy point after a 0.5% fall Monday, but there is no sell signal yet, according to IBD MarketSmith pattern recognition. IBD’s latest newsletter, MarketDiem, gives you actionable ideas for stocks, options and crypto right in your inbox. Dow Jones futures were lower ahead of Tuesday’s open, with first-quarter earnings season set to heat up this week. Netflix earnings are out Tuesday, while Tesla earnings are set for Wednesday.

Michael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, says a recession appears increasingly inevitable at this point, but investors shouldn’t necessarily be waiting on the sidelines. So far, the most convincing argument a soft landing may still be possible has been the resilience of the U.S. labor market. The Labor Department reported the U.S. economy added 311,000 jobs in February, widely exceeding economists’ expectations. The unemployment rate rose a bit to 3.6%, but that’s still down from 3.8% a year ago.

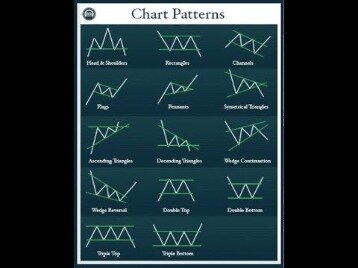

The fundamental stock analysis method involves the evaluation of a business at a basic financial level. Investors use fundamental analysis to determine whether the current price of a company’s stock reflects the future value of the company. Chart patterns are a subjective form of technical analysis where technicians attempt to identify areas of support and resistance on a chart by looking at specific patterns. These patterns, underpinned by psychological factors, are designed to predict where prices are headed, following a breakout or breakdown from a specific price point and time. For example, an ascending triangle chart pattern is a bullish chart pattern that shows a key area of resistance. A breakout from this resistance could lead to a significant, high-volume move higher.

As such, the technique relies on effective historical analysis. Amid Monday’s positive action, the market outlook remains in a confirmed uptrend, which means investors continue to have the green light to buy breakout stocks. IBD’s recommended exposure currently sits at 40% to 60%. Now is an important time to read IBD’s The Big Picture column with the stock market trend in a “confirmed uptrend” after continued gains.

And along with the work of others, it’s led to the field as we know it today. So it’s a good idea to learn both and know when to put them to work. Range breakout/brekdownif banknifty breaks 42000level then it may come down to 41800level. If it holds between and and breakout upside then it may to go upto 100 to 120 points a good move. If banknifty breaks 42000level then it may come down to 41800level. Live Options TradingJoin this educational stream to learn all about option buying and writing.

Screeners make it easy to analyze hundreds of stocks in a very short period by efficiently weeding out those that don’t meet your requirements. Trend analysis can help you pick optimum times to enter and exit stock positions — helping you become an overall better trader. Both upward and downward trends can be identified by using trend analysis. As for the trends themselves, they’re typically classified into up, down, and sideways. Up indicates growth over time, down indicates a price drop over time, and sideways indicates a price that has stayed relatively the same.